Quiet capital for businesses ready to take their next step.

Surve Capital provides relationship-based funding and invoice-backed solutions for small and mid-sized businesses that need support to grow, bridge cashflow gaps, or invest in new opportunities—without the noise or pressure of traditional lending.

About

Surve Capital

Surve Capital was created to support businesses that sit in the space between “too small for traditional banking attention” and “too solid for high-cost lending.”

We focus on practical, right-sized funding that helps owners cover short-term cashflow gaps, invest when opportunity knocks, and manage payroll and operating expenses during slower cycles.

Our approach is quietly conservative: we would rather structure the right solution than push unnecessary debt. Every relationship starts with a conversation about your business, not a form.

How Surve Works

-

A brief call to understand your model, contracts, and cashflow patterns. This allows us to quickly align our resources with your operating structure and pinpoint immediate optimization opportunities.

-

Together we determine whether invoice-based funding, microloans, or a focused bridge solution is the right approach. Selecting the optimal structure is the critical first step in preserving equity and supporting your projected growth trajectory. Our goal is to implement a solution that efficiently unlocks working capital without hindering future strategic opportunities.

-

Amount, duration, cost, and repayment laid out in straightforward language. We prioritize honest, simple communication to build a foundation of trust and eliminate any potential ambiguity. You will have a clear, precise understanding of every component, ensuring full confidence in your strategic financial move.

-

As your business evolves, we revisit your needs and adjust support up, down, or away as appropriate. This continuous review ensures your capital structure remains optimally aligned with your operating reality, protecting both your equity and cash flow. We function as a dynamic financial partner, ready to shift resources instantly to match new opportunities or changing risk profiles.

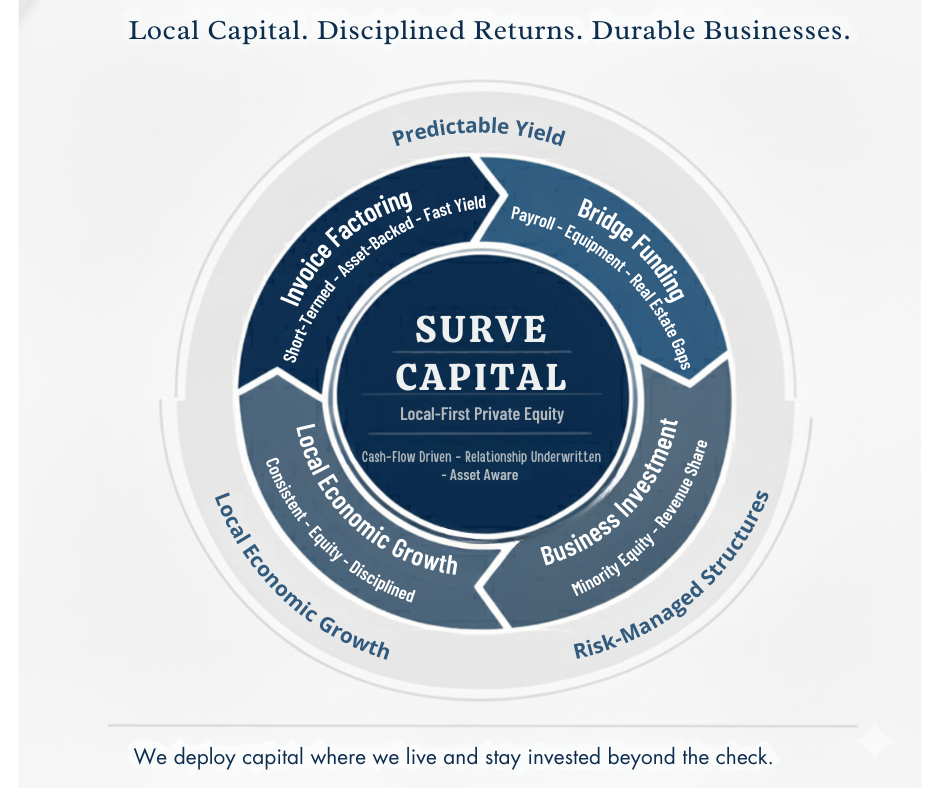

Surve Framework

We work with owners who:

Run service-based or B2B businesses

Need funding in the tens of thousands—not tens of millions

Operate in North Carolina and surrounding regions, including rural markets

Value discretion, direct communication, and long-term partnership

Who We Serve

Our Services

Invoice-Based Funding

Turn outstanding invoices into working capital.

Helpful when you’ve done the work and are waiting to be paid

Use cases: payroll, materials, covering vendor terms

Short-term support aligned with your receivables

Project & Expansion Microloans

Targeted loans to support specific initiatives.

Adding a new contract, service line, or location

Buildouts, equipment, early-stage staffing or marketing

Clear term, defined purpose, and repayment aligned with cashflow

Seasonal & Bridge Funding

Support during slower months or between large payments.

Helps balance cyclical revenue with steady obligations

Useful in ramp-up periods or temporary slowdowns

Designed to stabilize—never overextend—your business

Why Businesses Choose Surve

Selective and relationship-based. We focus on a smaller number of strong partnerships rather than volume.

Built by operators. We understand real-world cashflow, staffing, and timing—especially in regional and rural markets.

Calm, conservative capital. Sustainability comes before speed. We favor structures that keep you in control.

Aligned with your broader vision. Surve can sit alongside properties, staffing, and other ventures as part of a larger plan.

Let’s talk about what you’re building.

If you’re exploring how to fund growth, manage timing gaps, or prepare for a new opportunity, we’re glad to Surve as a sounding board.

-

info@survecapital.com